Conservatism is an ideology that benefits everyone, but it's particularly helpful to middle class Americans.

1) If a robber breaks into your house in the middle of the night,

you should be allowed to use a gun to defend your family. If a woman is being threatened by a rapist, she should be able to use a gun to protect herself. If a child molester is trying to kidnap your son, you have every right to keep him safe. If someone is

threatening the President of the United States or a celebrity, we all accept that their bodyguards should be able to use force to save their lives. Well, those of us who aren't rich shouldn't be left defenseless just because we can't afford bodyguards. We should have just as much of a right to safeguard our lives, our homes and our families as anyone else.

2)

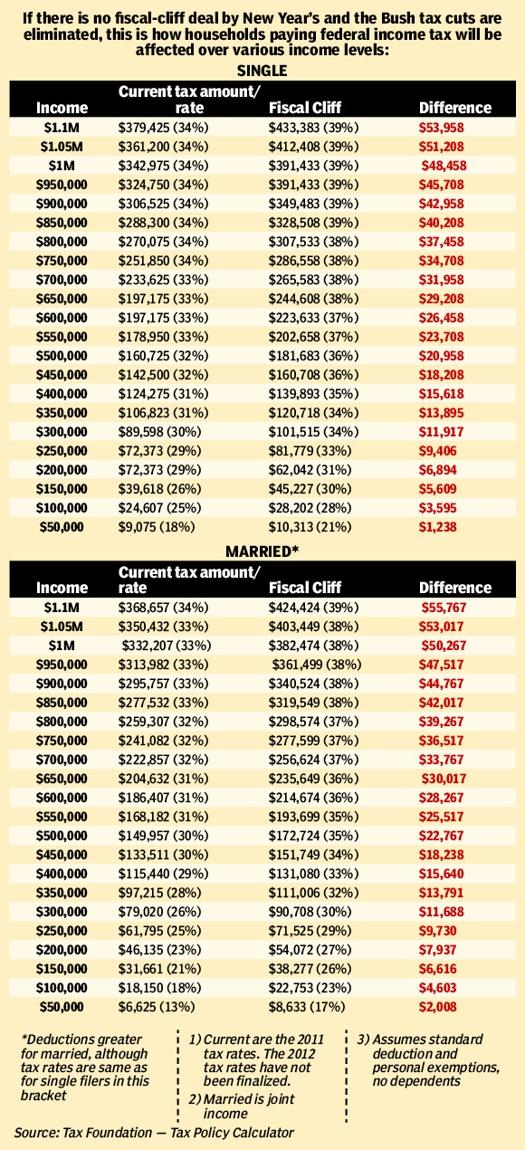

We don't believe in low tax rates for the rich; we believe in low tax rates FOR EVERYONE. The more you tax the rich, the less they invest, the more the economy suffers and the fewer jobs are created for the middle class. After all, you're never going to have a homeless man give you a job. Furthermore, despite all the rhetoric you hear to the contrary, the government can squeeze a lot more tax revenue out of the middle class than the rich. Inevitably, once the government raises taxes on the relatively small number of wealthy Americans, it always moves on to looting the middle class. In that sense, the rich are a tripwire. As long as their tax rates aren’t exorbitant, the middle class doesn’t have to worry about getting soaked either.

3)

Conservatives believe that the government should live within its means just like the average American family does. As a matter of fact, government deficits are actually much worse than a family overspending because the government is running up charges on YOUR credit card. For every last member of your family and every other family in America, from the newborn babe to the mother in the nursing home, the government has run up a debt of

$51,925. The bigger that number gets, the higher your future tax burden will have to be, the more debt your children will owe, the greater chance there is that

Social Security and Medicare will go belly-up and the more inflation will eat into the value of your savings. There is nothing more dangerous to the future prosperity of the middle class in America than the size of the debt.

4)

Conservatives are believers in small government not just because we believe that you can take care of yourself better than the government ever could, but because you can have

big government OR low taxes on the middle class, but over the long haul, you can't have both. You're much better off spending your money on your own behalf as you see fit than you are having the government take your money, waste most of it and then spend what's left over on programs you may not agree with in the first place.

5)

We conservatives believe in clean water, clean air, clean soil and respecting nature, but we also put humans above animals. We don't want farmers who've spent a lifetime tilling the soil so they'd have something to give to their kids driven out of business because a rare cockroach is found on their land. Furthermore, we don't believe the average American should pay hundreds, if not thousands more per year in hidden costs because of lawsuits filed by environmental extremists who'd like to make everything from automobiles to air conditioning illegal.

6)

Conservatives believe in school choice because we don't think any child should be trapped in a failing public school. As we've seen in almost every other part of American life, giving people a choice of how to spend their money leads to better products, better prices and better customer service. Rich Americans already have the option of sending their children to a private school. Given the amount of taxes most middle class Americans pay for schools, why shouldn't they have the same choice? If it's good enough for the President of the United States, why shouldn't you have the same choice about where your child is educated?

7)

The best way to protect the innocent is to be tough on the guilty. It's all well and good to talk about someone's hard life, the responsibility of "society" or the best way to rehabilitate him, but if you're beaten, your property is stolen or someone you love is taken away from you by a criminal, our first priority should be getting you justice, not doing what's best for the criminal. In fact, our second priority shouldn't even be doing what's best for the criminal; it should be making sure that he doesn’t harm anyone else. A society where we're tough on people drinking Big Gulps and soft on murderers is a society that is putting the interests of criminals ahead of law-abiding citizens.

8)

Yes, conservatives do want to reform Medicare and Social Security because that's the only way to save both programs. The government has promised 100 trillion dollars more in benefits than it has money to pay for and unless we take steps now to make both programs sustainable, eventually many Americans who’ve worked hard and played by the rules will be hit with large cuts to their benefits after they're retired when they can least afford it. Conservatives are willing to take that politically dangerous position because we want to protect the American people from that catastrophe before it's too late to change course.

9)

Conservatives believe in drilling ANWR, offshore drilling, opening up the keystone pipeline and taking advantage of clean coal technology, nuclear technology and exploiting this country's enormous natural gas reserves because that's one of the best ways to help middle class Americans put more money in their pockets. The less you pay to fill up your gas tank, heat your home and run your home appliances, the more money you'll have in your pocket at the end of the month.

10)

We oppose illegal immigration because it's unfair and disrespectful to the immigrants who obeyed our laws and did things the right way to give citizenship to illegals. It's also unfair to all the people in the middle class who've seen their salaries driven down because they've had to compete for jobs with illegals who don't pay income taxes, health insurance, or car insurance. Additionally, with the economy in such bad shape, how do we justify allowing tens of millions of foreigners who didn't play by the rules to stay here and take jobs from middle class Americans who are struggling to take care of their families? Every illegal alien who's allowed to stay here and work means one more American without a job.

Read More Here:

http://townhall.com/columnists/johnhawkins/2012/12/07/10_explanations_of_how_conservatism_helps_the_middle_class/page/full/